We are constantly making new additions to the Fantasy Points Data Suite. This week, we’ve released no fewer than five new reports that should make your weekly fantasy football, DFS, and sports betting research much easier.

In today’s article, I wanted to highlight each of these new tools and explain how they can help you dominate your fantasy league or help you win lots of money from your preferred Sportsbook.

1. Snap Share Report

You can find the Snap Share Report here.

Part of our aim when building the Fantasy Points Data Suite was to give you access to all of the weekly spreadsheets I build myself — the spreadsheets that fuel my articles, analysis, and rankings. Up until now, I had to manually compile this tool (and our next three) each week.

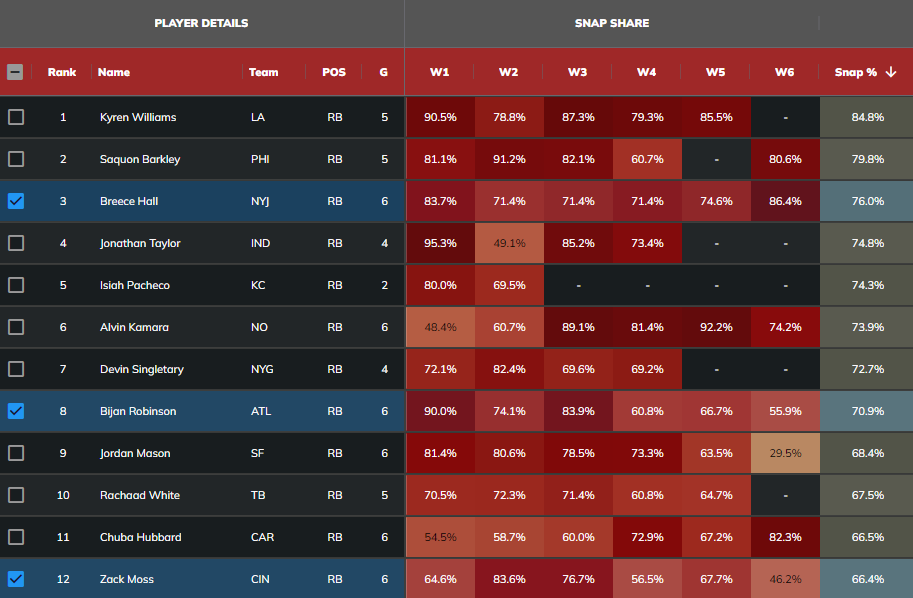

Snap share (a player’s snaps divided by the team’s total offensive snaps) is massively important for fantasy, and especially important at the RB position. Snap share correlates better, is stickier, and is more predictive of future fantasy points at the RB position than raw touches or even yards from scrimmage. Basically, the more your RB is on the field (the more opportunities for carries and targets), the better for fantasy.

But a player’s snap share can fluctuate wildly week-to-week. And if we notice an uptick in snap share that’s likely to stick, we can profit handsomely by acquiring that player via trade before his owner takes notice. Or better yet, by rostering that player in DFS before his price jumps.

For example, Breece Hall just saw his highest snap share of the season (86.4%) in his first game under new Jets offensive play-caller Todd Downing. Braelon Allen played on just 18.6% of the snaps, his lowest rate since Week 1. It appears Hall is back to being the high-end bell cow RB1 we hoped we were drafting before the season. He’s a logical trade target if his owner is still worried about Allen.

On the other end, Bijan Robinson’s snap share has only declined since Week 1, bottoming out at a meager 55.9% last week. Correspondingly, Tyler Allgeier has seen at least a 34% snap share over each of his last three games, after posting a high of just 22.4% over his first three games. This may be due to the shoulder and hamstring injuries that have limited Robinson’s practice time over the past three weeks — so this could turn around once he’s healthy — but if you can still extract top-5 RB value for Robinson in trade coming off his 25.5-point performance against the Panthers, you may be justified in doing so.

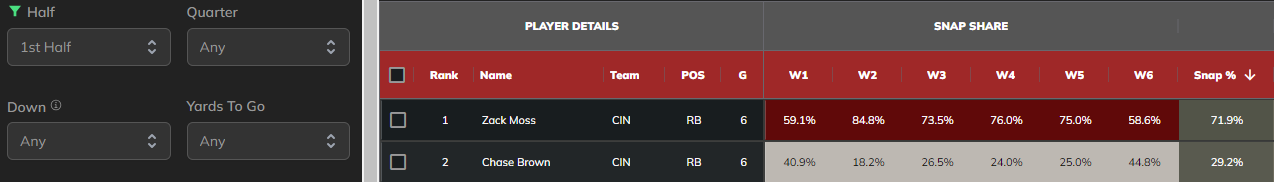

Finally, Zack Moss’s snap share took a nose-dive to 46.2% in Week 6 after a fumble early in the second half. But using the Data Suite’s filters, we can see the change was already occurring in the first half, before the fumble; Moss had his lowest first-half snap share of the season (58.6%) after being well above 70% each of the previous four weeks. This would be a great time to check in on the cost of Chase Brown in your league, as he possesses significant upside should he walk away with RB1 duties; he currently ranks 3rd among all RBs in fantasy points per snap.

2. Route Share Report

You can find the Route Share Report here.

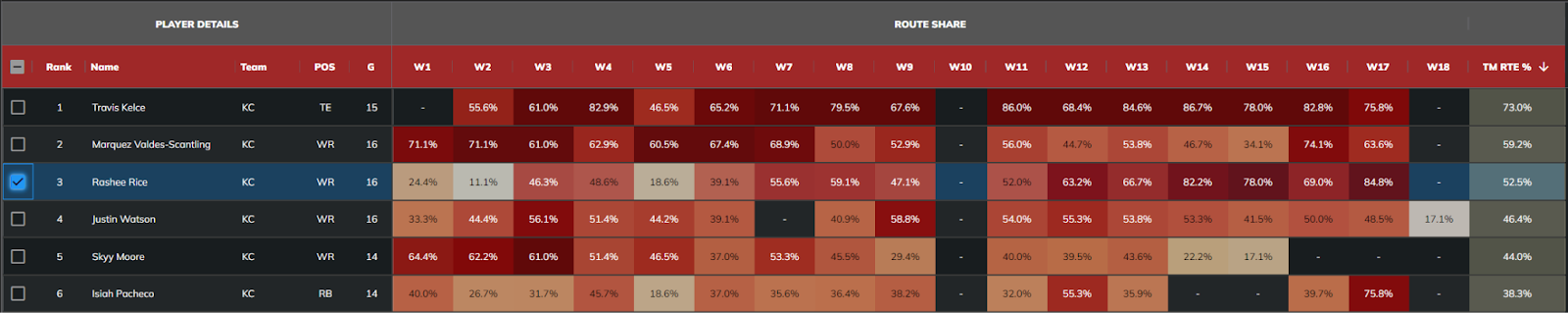

The Route Share Report is very similar to our last tool, except now we’re looking at Route Share (a player’s routes divided by team dropbacks).

Snap share is more important for RBs, but route share matters more for WRs and TEs. For instance, Rashee Rice was on our radar early into the 2023 season. Heading into Week 8, Rice was 6th among all WRs in YPRR (2.96) but he ranked just 92nd in total routes run (34.3% route share). It wasn’t until Week 12 that he finally ran a route on at least 60% of his team’s dropbacks. From this point on, Rice’s FPG average jumped from 10.2 (49th) to 18.6 (7th).

If you had access to this tool last year, you might have been able to buy low on Rice before his league-winning stretch run or would have at least known to target him in DFS during it.

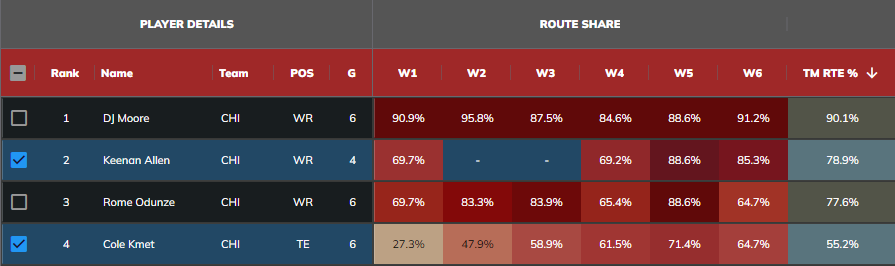

This past week, keeping an eye on the Bears’ route shares could have given you the confidence to start Cole Kmet and Keenan Allen. Kmet had not scored more than 8.7 fantasy points in Week 4 or Week 5, but his route share was consistently climbing. Seeing that could have given you the confidence his Week 3 was not a mirage, letting you reap the benefits of his 24-point performance in Week 6.

Similarly, Keenan Allen’s route share spiking to 88.6% in Week 5 was a signal he was fully back from his injury. He caught two touchdowns and scored 21.1 fantasy points in Week 6.

3. Target Share Report

You can find the Target Share Report here.

This is just like our last two new tools, except now we’re looking at target share (a player’s targets divided by a team’s total pass attempts).

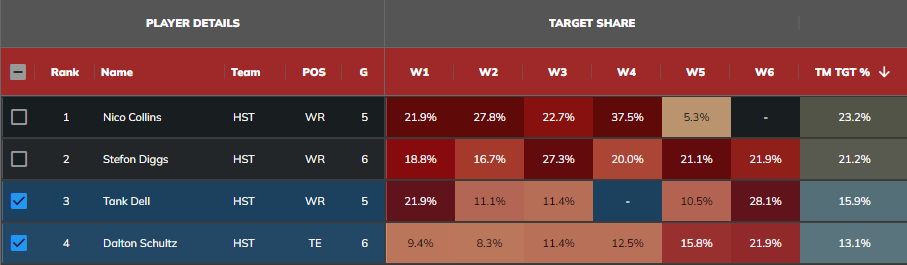

With Nico Collins now on IR through at least Week 10, it’s worth checking in on how the Texans’ target shares were distributed in the team’s first game without him. As you can see above, Tank Dell and Dalton Schultz each saw their highest target share of the season (28.1% and 21.9%, respectively), while Stefon Diggs’ role has not grown at all.

Flipping the tool back to 2023 also allows us to quickly notice that Dell’s highest target share of his career (35.9%) came in the only other game he’s played without Collins. He averaged 18.8 FPG and was above a 90% route share in each of those two games, as well — I’m expecting great production from Dell over the next month.

4. Pass Rate Over Expectation Report

You can find our Pass Rate Over Expectation Report here.

It should be intuitive to target QBs, WRs, and TEs on teams with high pass rates and RBs on teams with low pass rates. Pass rate is a usable-but-imperfect stat for fantasy, too heavily influenced by game script and situation. (Last year, teams threw the ball 89% of the time on 3rd-and-10 versus just 27% of the time on 3rd-and-1. Teams ran the ball 54% of the time when leading by multiple scores versus just 32% of the time when trailing by multiple scores.) Pass rate over expectation (PROE) controls for all of this to give you a better sense of a team’s true tendencies.

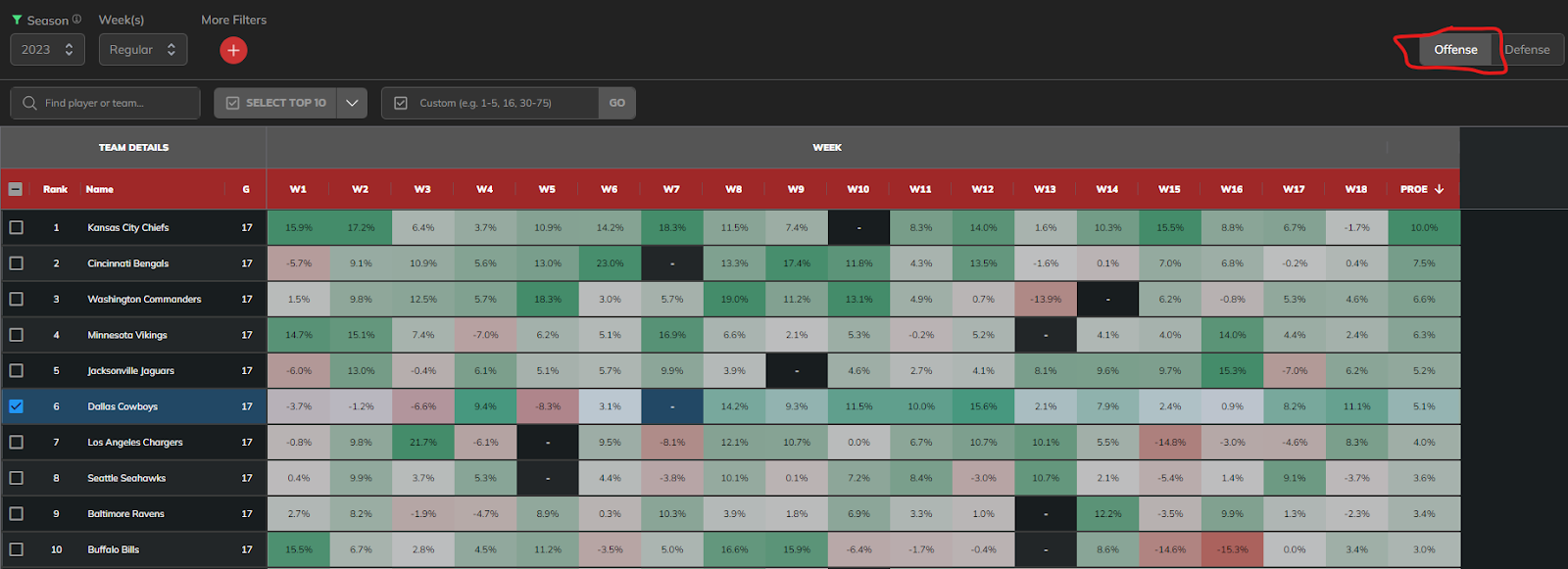

Dallas is a prime example from 2023. They started leaning far more pass-heavy after their bye, shifting from a -0.9% PROE (9th-lowest) to +8.4% (highest). Uncoincidentally, Dak Prescott jumped from 22nd (14.6) to 2nd in FPG (24.2) over this stretch. From Week 9-on, CeeDee Lamb averaged a position-high 27.5 FPG (+5.7 more than the next-closest WR) and became the most valuable player in all of fantasy.

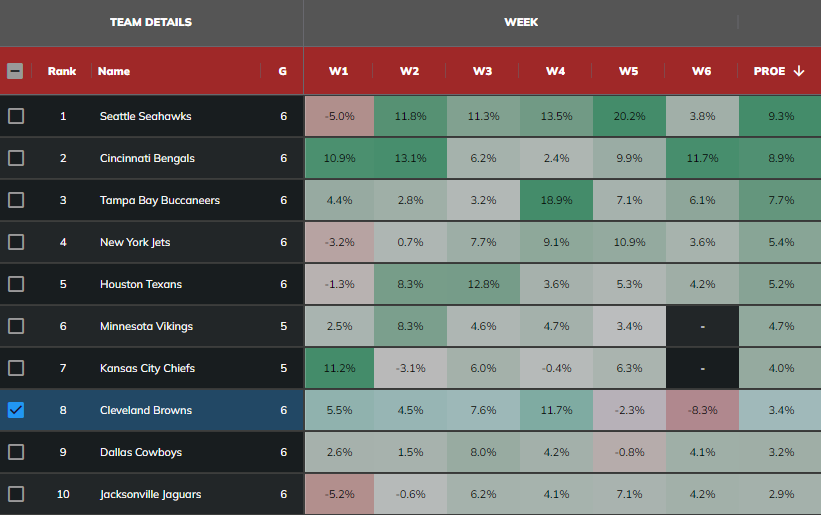

The 2024 Cleveland Browns are another interesting case study. They dropped back very frequently early in the year, averaging a +7.2% PROE (4th-highest) through the first four weeks. However, with Deshaun Watson having little success, they’ve gone notably more run-heavy over the past two weeks, averaging a -5.1% PROE (5th-lowest). The team just traded away its WR1 (Amari Cooper) and expects Nick Chubb to return from injury in Week 7. Chubb is no sure thing after suffering a devastating knee injury last year (MCL, ACL, meniscus), but the team’s shift toward the run could benefit fantasy teams that had stashed him on IR.

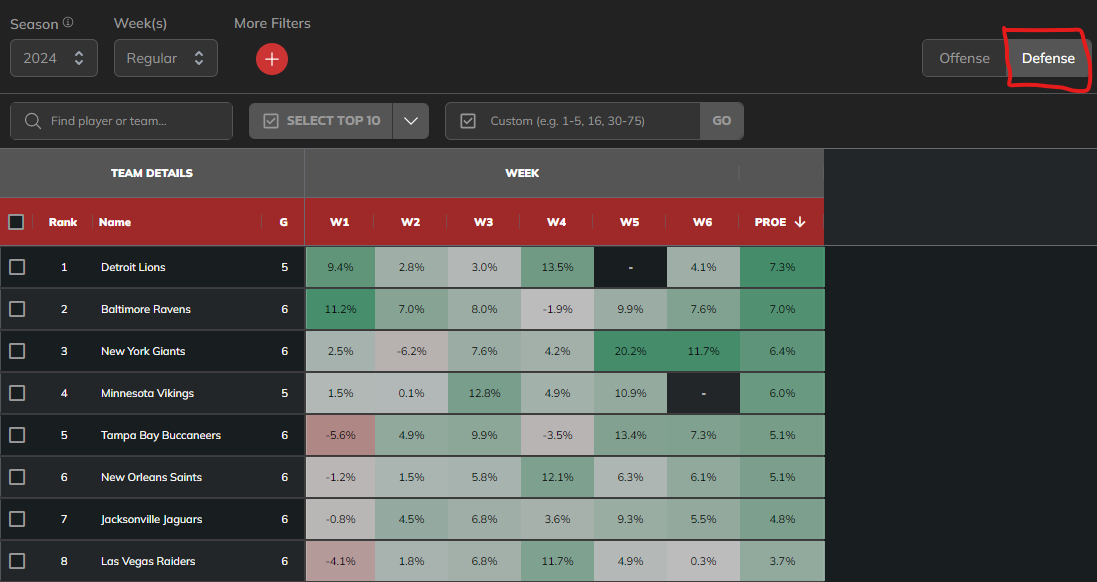

Thus far we’ve only looked at offenses by PROE. At the top-right-hand corner, you can also toggle your view to look at the top defenses by PROE allowed.

What does this tell you? The Lions (+7.3%) have been the league’s top “pass-funnel” defense this year – given their personnel or scheme, they have forced teams to lean far more pass-heavy than they typically would. Or, in other words, it would make sense to target Minnesota QBs, WRs, and TEs and avoid their RBs in DFS, as they play the Lions this week. Jake Tribbey used this exact tool to make the case for Sam Darnold in his Week 7 DFS Early Look.

5. Fantasy Points Scored Report

You can find our Fantasy Points Scored Report here.

This is the simplest and most self-explanatory of the five newly-released tools, as it displays the fantasy points scored each week by each player in a grid format. But that doesn’t mean we can’t extract useful insights from it. Notice above that Derrick Henry had a slow start to the year but has averaged 27.0 FPG (the most of any RB) since. What changed?

When we use the Data Suite to filter only for games Henry’s team won, we get a clear picture. The Ravens won each of their four most recent games, allowing Henry — the most game script-sensitive player in fantasy football history — to go on an absolute tear.

If the Ravens are big favorites by betting odds (as they were against Washington last week), it makes sense to play Henry in DFS. On the other hand, if the spread is closer (like this week, where it’s just 3.5 points against the Buccaneers), it may make sense to fade him in DFS, as there’s more risk he gets scripted out of the game if the Ravens fall behind. (Justice Hill has out-snapped Henry 67 to 39 when Baltimore has trailed this year.)

Don’t miss out!