In my previous breakdown at Fantasy Points, we explored the key coverage alignments found in today’s NFL, examining recent history, the major components, schematical designs, and where the league can be expected to go in the future.

We’ll now turn our attention to exploiting those tendencies in fantasy football, paying particular attention to best ball and daily fantasy football (DFS). The ultimate goal of this series is to better understand the context behind micro and macro matchups on the football field, which will aid gamers in start-sit decisions, DFS contests of all sizes, best ball correlation, and more.

The data for this series was sourced from the Fantasy Points Data Suite, with the lone exception being the table provided in the below section (TruMedia, which uses PFF data).

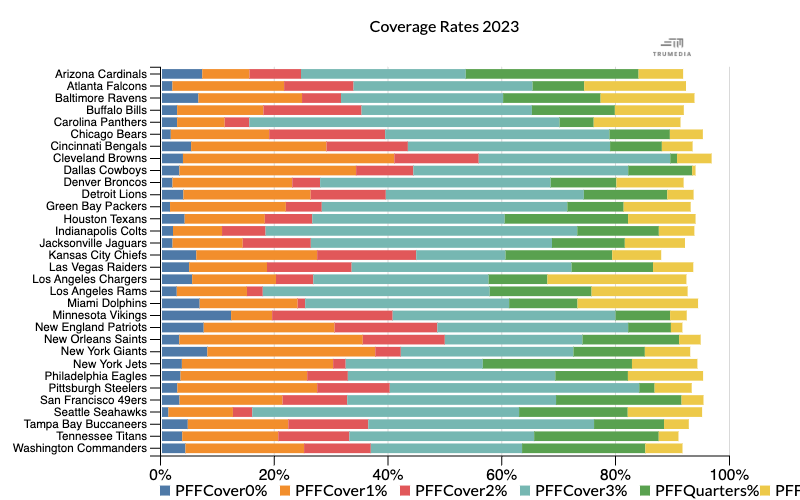

League-Wide Coverage Rates

Before we jump into the data on how players performed against various coverages in 2023, let’s take a moment to examine the team-by-team coverage shell rates from last season. The table below illustrates each team’s coverage rates in Cover-0, Cover-1, Cover-2, Cover-3, Cover-4 (or quarters), and Cover-6 , respectively. (The yellow bar is Cover-6.)

While other coverage schemes are in use in the NFL today, these six represent over 90 percent of the league-wide coverages from last season. I also left out more broad descriptors like single-high and two-high as those are more expressive of what the quarterback sees prior to the snap as opposed to relating to what the defensive responsibilities are during the play (there is some nuance to that discussion that we won’t fully dive into here).

As was uncovered in the previous piece, Cover-3 (35.8 percent) and Cover-1 (18.9 percent) made up almost 57 percent of the league-wide coverage snaps in 2023. Adding the 14.2 percent Cover-4/quarters rate brings the composite coverage rate of the three primary coverages to almost 71 percent, making those three coverage shells the most important to us as we discuss the archetype of pass-catcher we’re looking to target in drafts, in DFS, and in trades.

Targeting Cover-0

Cover-0 is a little tricky to pull sweeping trends out of due to the league’s modest usage of the alignment (a league-wide average of just 4.1 percent of defensive snaps in 2023 came from Cover-0). Through that angle, targeting Cover-0 is more about “which defenses play the most Cover-0” than it is “this archetype of wide receiver is what you target Cover-0 with.”

Even so, a couple of data points stood out through the small sample size of Cover-0 utilization last season.

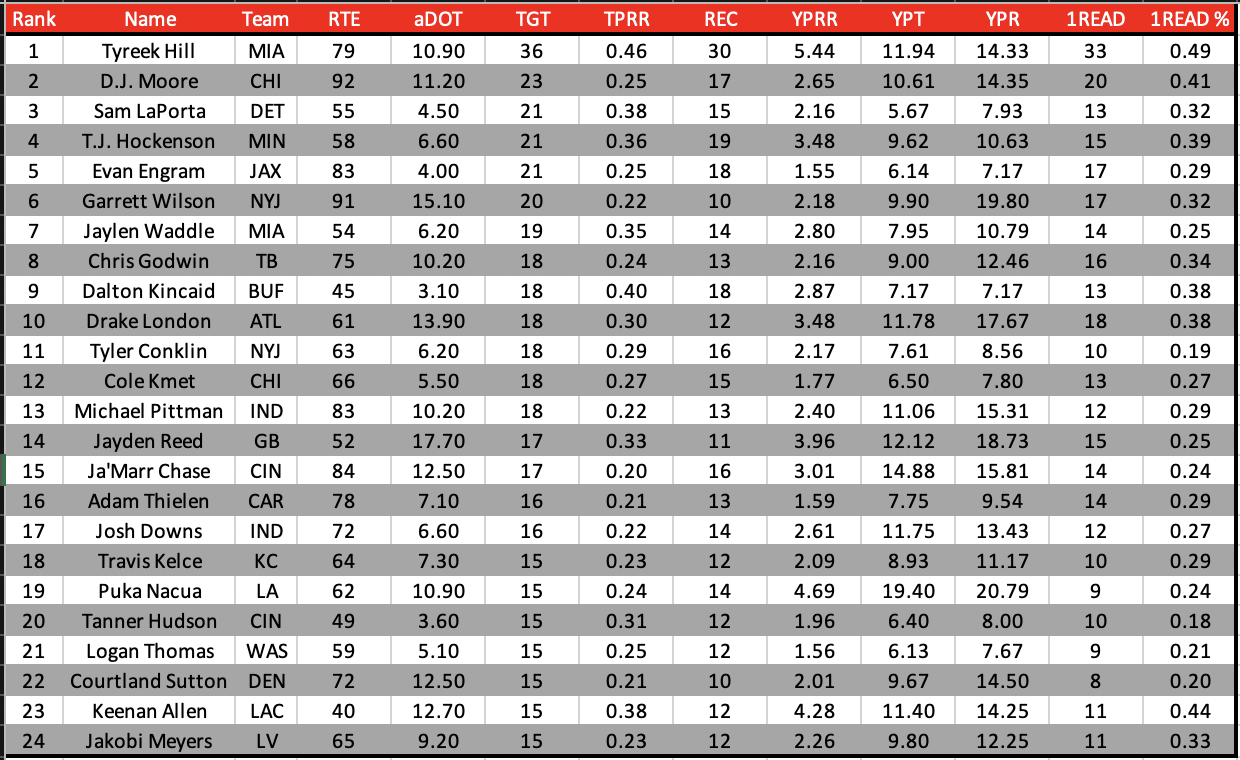

The above table shows the top 24 pass-catchers in targets against Cover-0 in the 2023 season. We’re normally looking to macro trend items — like TPRR and first-read target rate — through small sample sizes, but a few data points stood out here.

First, Christian Watson ran just six routes against Cover-0 during an injury-riddled season and yet saw a target on each route, also bringing a solid 12.0 aDOT on those targets. That is notable, considering the Packers will play the Vikings twice each season, and Brian Flores’ Vikings defense led the league in Cover-0 rate in 2023 (12.1 percent).

Second, Mike Evans ran just eight routes against Cover-0 a season ago but also saw a target on each route. His yards per route run against Cover-0 in 2023 (4.13) also paced the league, of pass-catchers that saw five or more targets in that split. Furthermore, he was the first read on each route and gets the value of continuity with both he and quarterback Baker Mayfield returning on new contracts.

Third, Bills tight end Dalton Kincaid is the only player on this list who does not play wide receiver and held solid underlying metrics — including a 38 percent TPRR, 10.4 aDOT, and 3.24 YPRR against Cover-0 — in his rookie season. Gabe Davis's departure via free agency this offseason should provide an avenue for the soon-to-be second-year tight end to continue to grow in Buffalo.

Finally, D.J. Moore’s exploits against Cover-0 last season highlight his adept ability to get open against man coverage. Moore’s 0.77 FP/RR against man coverage in 2023 ranked behind only Tyreek Hill (1.22, lolz) and CeeDee Lamb (0.99). The dude is a legitimate force in the league and should be treated as such by drafters and DFSers alike, regardless of who is under center in 2024. Furthermore, the addition of Keenan Allen (third in the chart above) in Chicago likely means Moore will be seeing more one-on-one coverage on the perimeter moving forward.

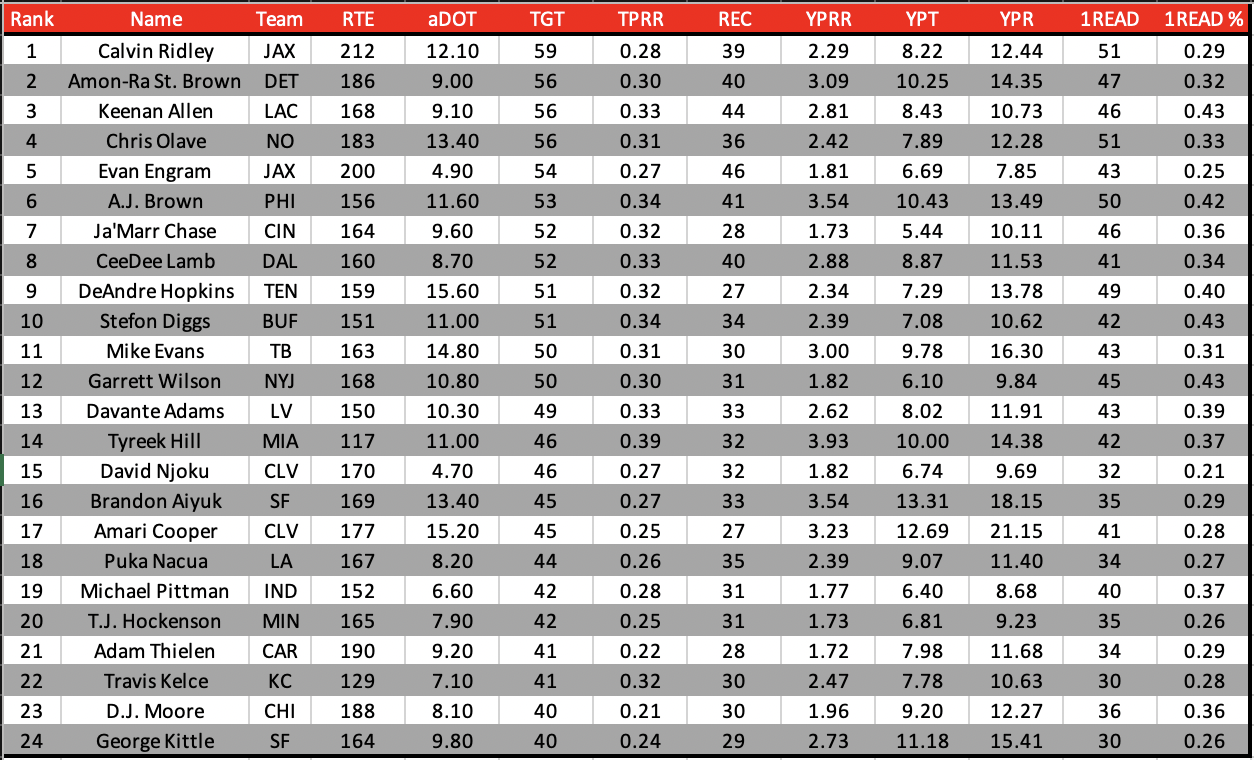

Targeting Cover-1

Reinforcing the previous discussion, D.J. Moore again makes his presence felt against another man coverage, leading the league (of qualified pass-catchers) in YPRR against Cover-1 (4.78) and flashing elite marks in first-read target rate (40.6 percent), YPT (17.03), and YPR (23.23) while posting a solid (yet not elite) 28 percent TPRR. It’s obvious — we should be targeting Moore against teams that utilize high rates of man coverage alignments in the coming season.

CeeDee Lamb (4.76 YPRR, 36 percent TPRR, 38.4 percent first-read target rate) and A.J. Brown (4.24 YPRR, 44 percent TPRR, 44.3 percent first-read target rate) join Moore as truly elite against Cover-1 alignments.

Lions rookie tight end Sam LaPorta edging breakout wide receiver Amon-Ra St. Brown in all meaningful metrics outside of first-read target rate against Cover-1 was surprising, to say the least. LaPorta put up downright elite numbers in TPRR (35 percent) and YPRR (2.88) in his first season in the league, which should only improve as he continues his growth. Targeting LaPorta against teams that utilize heightened rates of Cover-1 in DFS in the coming season might be one of the great cheat codes for those paying attention.

Chris Olave was also somewhat quietly elite against Cover-1 in 2023, posting the fourth-highest YPRR (3.80) and an elite 33 percent TPRR. And even then, there is room to grow in his modest 29.3 percent first-read target rate. We don’t yet know when the Saints will play the Browns (who led the league in Cover-1 utilization in 2023 and return the same defensive coordinator in Jim Schwartz), but we do know the two teams are playing each other in 2024. I have that game circled already. The Saints also play the Cowboys and Giants in the coming season, two teams that were near the top of the league in Cover-1 rate a season ago, but both teams see a change at defensive coordinator for the new year.

The other names on this list can best be described as “alphas,” at least on their respective teams. The ball simply tends to find a team’s top option against man coverage, as those are the players most likely to win in one-on-one situations. We spoke briefly about safety manipulation in the previous piece, which becomes extremely important against Cover-1 alignments due to the fact that there is only one free member of the secondary on the field – this also helps to explain why team alphas typically feast against Cover-1 alignments as safeties can be held or manipulated through things like play design, quarterback body positioning and eye/head movements, and pre-snap motion.

Targeting Cover-2

Cover-2, and its many variations, used to be one of the most prominent coverage alignments found in the NFL. Over the last decade-plus, however, defensive coordinators have fallen out of favor with the once-dominant scheme, resulting in a stark decline in Cover-2 utilization in recent history. The league-wide Cover-2 utilization rate fell to a paltry 10.5 percent in 2023 as the dynamics of the league have shifted more towards fluidity on the defensive side of the ball.

Even so, some (rather elite) coordinators have found a way to incorporate Cover-2 effectively, namely Steve Spagnuolo in Kansas City (above-average 17.2 percent Cover-2 rate) and Brian Flores in Minnesota (league-leading 21.2 percent Cover-2 rate). It will be particularly interesting to see how the Chiefs begin the season on defense, considering the amount of communication and intricacies that are present and required in Spagnuolo’s system now that L’Jarius Sneed is no longer with the team.

One interesting nugget from the data above is the sheer number of routes the Miami Dolphins run against Cover-2 formations as opposing defensive coordinators almost unanimously refuse to play man coverage against them, and, to be frank, rightly so. Both Tyreek Hill and Jaylen Waddle finished the 2023 season top-seven in targets against Cover-2, while Hill put up elite underlying metrics, including a robust 46 percent TPRR, 5.44 YPRR, and 48.5 percent first-read target rate.

It makes sense that the Cover-2 data is riddled with tight ends after our exploration of the strengths and weaknesses of the coverage in our last discussion. Furthermore, we find numerous “underneath” players on the list as well. Brett Kollmann added an interesting thought to this discussion on Twitter, saying the recent rules changes are likely to increase the emphasis on tight ends over the flat.

Tight ends, slot wide receivers, and players adept at identifying the holes in coverage behind the linebackers and in front of the secondary thrive against Cover-2. That last remark typically points to veteran X-type receivers (the Keenan Allens of the world), making Puka Nacua’s metrics against Cover-2 in his rookie season more impressive. Nacua’s 4.69 YPRR ranked second behind only Tyreek Hill, of qualified pass-catchers, and there remains significant room to grow in his role with the Rams considering modest marks in TPRR (24 percent) and first-read target rate (24.3 percent).

This is the first list that you’ll notice one key name missing – Amon-Ra St. Brown. As was touched on in multiple places thus far, St. Brown took his game to another level in 2023 via elite route-running abilities and his propensity to generate separation in all areas of the field. That said, it is clear that offensive coordinator Ben Johnson and the Lions staff prioritized the mismatches they could create with Sam LaPorta against slower linebackers and undersized safeties against Cover-2. That is of particular importance, considering the Lions play the Bears twice, and Chicago utilized Cover-2 at a 20.4 percent clip in 2023 (second-highest in the league). In other words, skipping over St. Brown against the Bears in the coming DFS season might be a good idea.

The final interesting note against Cover-2 is Packers wide receiver Jayden Reed’s elevated aDOT against a coverage designed to mitigate downfield passing. His ridiculous 17.1 aDOT against Cover-2 in 2023 handily paced the league, of qualified pass-catchers, giving us a solid glimpse into the tendencies of head coach and offensive play caller Matt LaFleur against various coverages.

The interesting aspect of that data point has to do with safety responsibilities in various “two-high” alignments, including Cover-2, Cover-4/quarters, and Cover-6. Teams have been able to relentlessly deploy slot fade routes against Cover-4 due to the positioning of the safeties in that formation (closer to the line of scrimmage). It appears as if LaFleur has been able to manipulate the safeties in Cover-2 to draw them closer to the line of scrimmage, most often coming through layered route trees and play action after establishing the run.

We should be targeting Reed against teams that utilize elevated rates of Cover-2 while targeting Christian Watson against teams that utilize elevated rates of man coverage.

Targeting Cover-3

Cover-3 has become the dominant coverage alignment found in the league today, with a league-wide usage rate of 35.8 percent in 2023. Numerous teams ran Cover-3 at outlandishly high rates a year ago, namely the Colts (54.8 percent), the Panthers (54.5 percent), the Seahawks (46.9 percent), the Steelers (43.9 percent), the Packers (43.2 percent), the Jaguars (42.2 percent), and the Broncos (40.5 percent).

It should come as no surprise that alpha pass-catchers eat against Cover-3 due to the alignment's more “prevent” nature. In other words, it becomes easier for opposing offensive coordinators to scheme their best player the football against coverage that does a lot of things well but nothing elite. That helps explain why we see so many players with TPRR values over 30 percent against Cover-3 and also re-emphasizes the heightened first-read target rates against the coverage.

With that, a few interesting data nuggets stood out to me in this data set. First, Evan Engram and Calvin Ridley were amongst the league leaders in targets against Cover-3 in 2023. Now that Ridley is out of town, Engram has an opportunity to feast against the most often-utilized coverage scheme around the league. That also makes Engram an intriguing value option in early best ball drafts at an ADP of TE8.

Tyreek Hill (3.93), A.J. Brown (3.54), Brandon Aiyuk (3.54), Amari Cooper (3.23), Amon-Ra St. Brown (3.09), and Mike Evans (3.00) were the leaders in YPRR against Cover-3 a season ago, with Aiyuk the biggest surprise on that list. One of the biggest challenges with the 49ers is identifying which player amongst their elite playmakers is likeliest to erupt on a given week, posing not “will the 49ers find success,” but “where is the success likeliest to come from?” With that, Aiyuk is an elite option against teams that utilize elevated rates of Cover-3 moving forward.

The Bears also jump off the page after their offseason acquisitions this year. It becomes evident that we should target DJ Moore against man coverages and Keenan Allen against zone coverages moving forward. The collective fantasy community could be slow to latch onto those trends early in the year, particularly considering they are likely to have a rookie quarterback under center. I will not be shy in hammering that edge early in the year and am interested in stacking either with (likely) Caleb Williams before the field catches up.

Man vs Zone YPRR since 2022

— Football Insights 📊 (@fball_insights) March 15, 2024

Bears taking no risks with their rookie QB pairing Keenan Allen with DJ Moore. Let CAR be a cautionary tale pic.twitter.com/xGw1o0TnhE

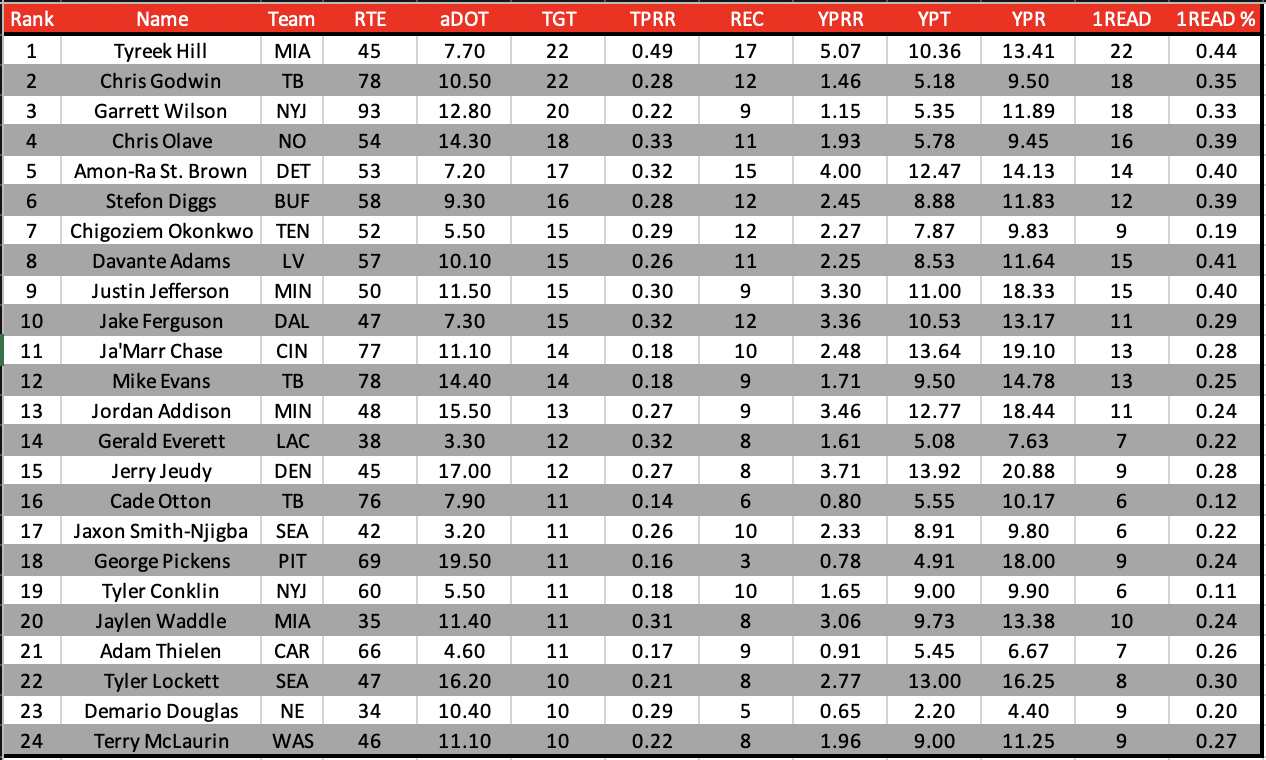

Targeting Cover-4/Quarters

Cover-4/quarters alignments are gaining popularity in the league due to the fluidity of the scheme itself. Defensive coordinators can mix man and zone coverage principles, dedicate additional assets to stopping the run, and make the alignment appear static before the snap. These benefits resulted in a league-wide 14.2 percent utilization rate in 2023, with the Cardinals (30.4 percent) and Jets (26.2 percent) pushing the envelope as they each moved to more dynamic defenses compared to years past. We highlighted the expectation for improvement from Jonathan Gannon’s defense moving forward in the previous piece, but I wanted to emphasize it once again here.

Puka Nacua (39 percent TPRR, 41.7 percent first-read target rate) and Amon-Ra St. Brown (38 percent TPRR, 45.6 percent first-read target rate) put up elite numbers against Cover-4/quarters in 2023. Nico Collins was also, somewhat quietly, elite against this primary coverage a season ago, posting a robust 3.04 YPRR.

But the most shocking was the absurd 5.34 YPRR and 41 percent TPRR amassed by Jaylen Waddle against Cover-4/quarters. That is of particular intrigue, considering the Dolphins play the Jets twice (duh) and Cardinals once in 2024, the two teams that led the league in Cover-4/quarters utilization a season ago. That could help explain the absolute eruptions against the Jets in 2023, when Waddle went 8/114 and 8/142/1 in two games. Those two games marked two of the three instances of Waddle eclipsing 100 yards through the air last year. We typically see DFS players quick to “pivot” off of Tyreek Hill as they search for leverage away from one of the highest-owned players on the slate, but I might be more willing to do so in these matchups.

Targeting Cover-6

The league-wide Cover-6 utilization rate was just 9.5 percent in 2023, marking the second-lowest usage of all coverages last season. And even though there were a select few teams that utilized this coverage at elevated rates last year (the Chargers and Dolphins were the only two teams above 20 percent utilization at 24.4 and 21.2 percent, respectively), the top five teams in Cover-6 utilization from a season ago all have new defensive coordinators heading into 2024. Honestly, there isn’t much to be gleaned from this data.