This article series is a deep dive into all of the metrics that our fantastic data collection team has procured from charting every single NFL game over the last two years.

We are thrilled to offer access to our entire hub of tools to you for $200 ($50!!) for the 2023 season. The Fantasy Points Data Suite will be your go-to for NFL research – forever. Our fast filtering system displays hundreds of data points in seconds, all quickly digested into your preferred fantasy scoring system.

With the last two years of Fantasy Points Data at my disposal, I studied which stats matter the most at each position regarding fantasy football. To do this, I ran correlation tests across hundreds of metrics – seeking statistical signals.

What We’re Studying

For this study, we only want to look at fantasy-relevant tight ends. To ensure part-time players don’t skew the numbers, only TEs with at least 25 targets and 150 routes run and at least four games played were included.

This data spans the last two seasons (2021-22). The total sample size = 94 TEs.

Fantasy scoring is Half PPR.

All correlation data is ranked by strongest (+1 | perfectly positive), weakest (0.0 | no correlation), to negative (-1 | perfectly negative).

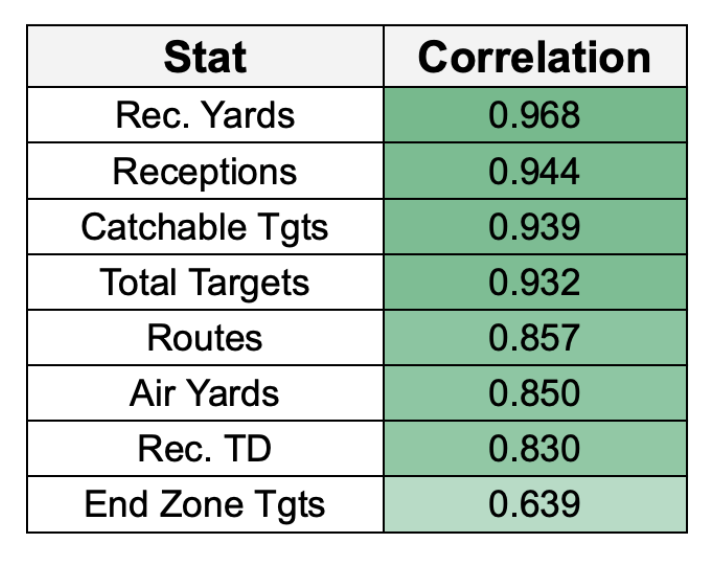

Volume Receiving Stats

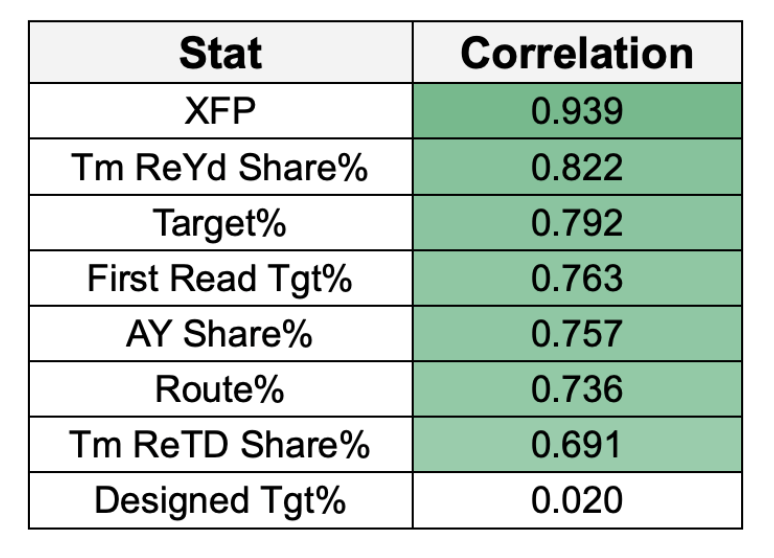

Usage Receiving Stats

As we’ve seen across all skill positions in this series, volume stats significantly outweigh efficiency metrics in their relative importance to our fantasy game.

Targets and routes > efficiency.

Outside of Travis Kelce, tight ends are the biggest pain in the ass in fantasy football. How many times in your life have you picked up what you thought was a decent TE streamer, only for them to have 2 receptions for 18 yards? (Take it from my experience: writing a fantasy TE streamers article in-season will quickly humble you.)

Touchdown variance is the main culprit of why we can’t ever seem to figure tight ends out.

Unlike RBs, WRs, and especially QBs, touchdowns are extremely random and difficult to predict at tight ends.

Here is a look at how total touchdowns scored correlate to positional fantasy points over the last two years:

Tight ends live and die by TDs

| Position | TD-to-FP RSQ |

| QB | 0.931 |

| RB | 0.734 |

| WR | 0.661 |

| TE | 0.571 |

The right value is the r-squared (RSQ) relationship between total touchdowns scored (rushing, passing, and receiving) and total fantasy points scored.

RSQ measures variance for a dependent variable (in this instance, fantasy points) that’s explained by an independent variable (touchdowns).

For context, this means that 93% of the scoring variance for quarterbacks is explained by touchdowns alone, while that figure for tight ends is just 57%.

But, wait. It gets worse.

I wanted to see how much pull Travis Kelce had on this data since he has scored a position-leading 21 TDs over the last two years. My guy Scott Barrett coined the term “Power Law” player a few years back, and there has not been a bigger example of a “Power Law” tight end than Kelce.

After removing Kelce from the study, the RSQ relationship between TD-to-FP dips even further to a pitiful 0.472 for tight ends. This means that less than 50% of the seasonal scoring variance we see at tight ends is explained by touchdowns if we remove the TE1. Unreal.

This is where TEs go to “die” in my analogy. If you’re a tight end who is not Kelce, and you’re not scoring TDs with some level of consistency, you’re likely worthless in fantasy.

There are very few tight ends that see a lot of weekly target volume, and that’s why having Kelce any year recently, Mark Andrews in 2021, or George Kittle during his 2022 playoff run is so valuable.

While TE can be extremely frustrating, it’s clear we need to chase volume.

Crucially, targets are extremely sticky (likely to repeat) year over year at tight end. This is just like wide receivers. Target share “sticks” with 0.695 correlation year over year for TEs, and that figure for wide receivers is 0.726.

This means that we can reasonably project that the previous seasons’ target share leaders are likely to repeat once again.

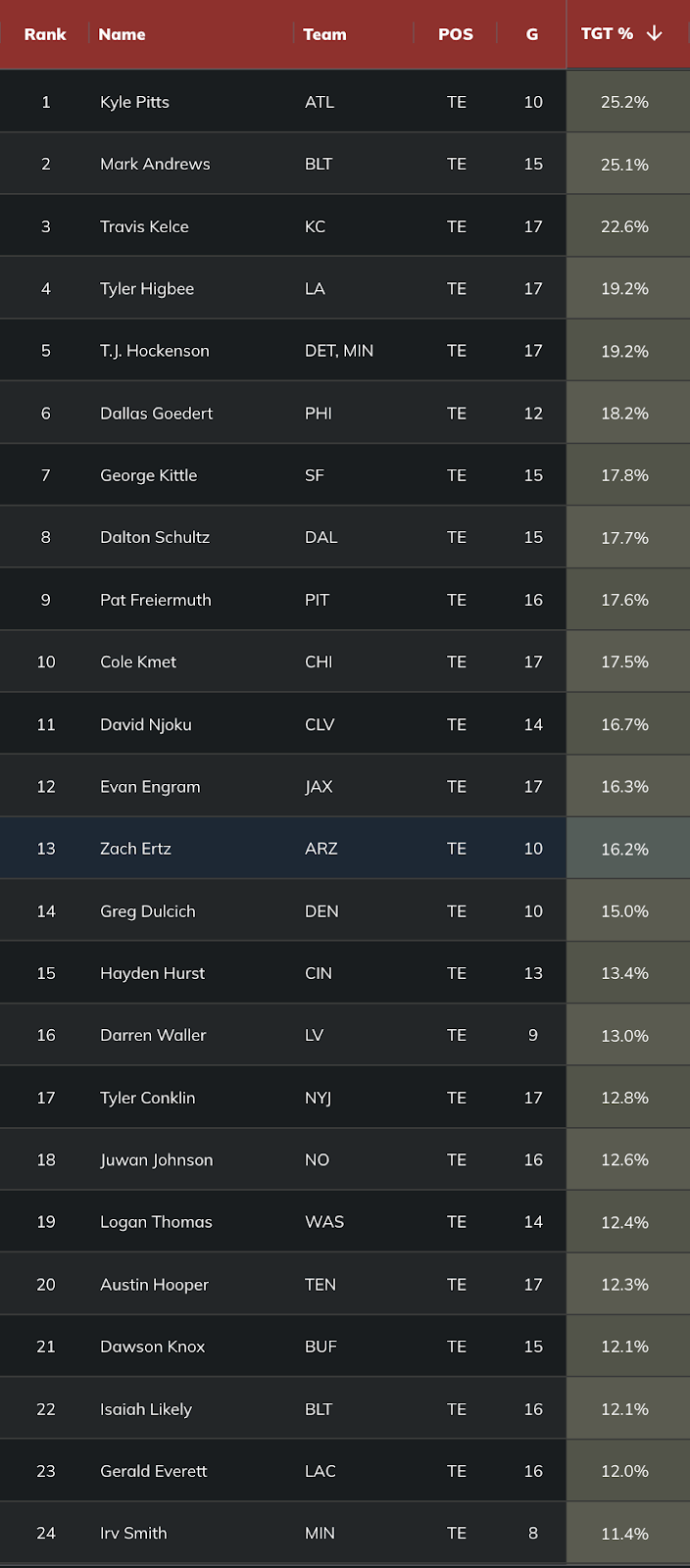

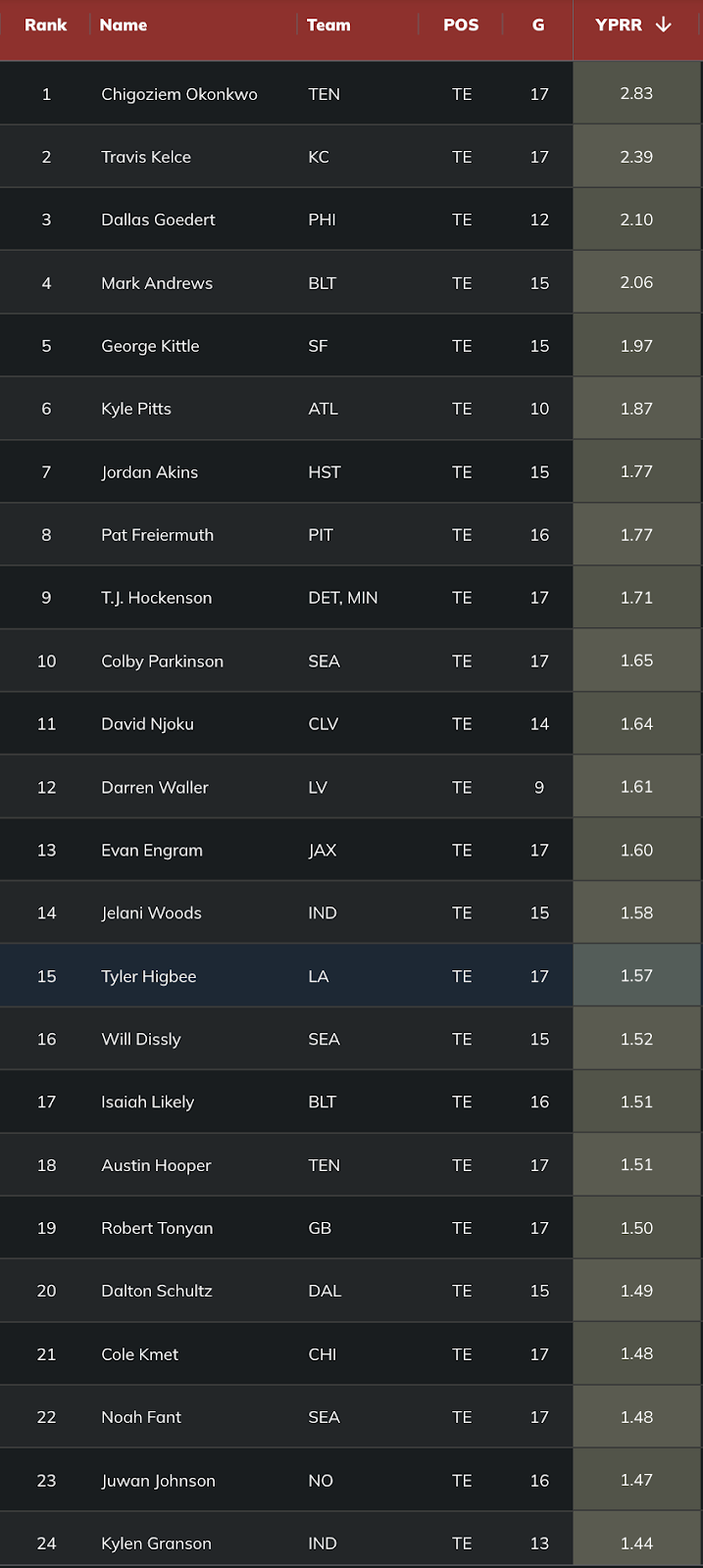

So, with that in mind, here are the top-24 tight ends from 2022 by target share:

Target share takeaways

Kyle Pitts was inarguably one of the most unlucky receivers in football last season, ranking first in target share (25.2%) but dead last in percentage of targets that were catchable (64.9%). If Pitts had just seen “average” QB play and performed at his baseline (by expected fantasy points), he would have finished as the TE4 in fantasy points per game before his knee injury. We have similar accuracy concerns with new starter Desmond Ridder that we did with Marcus Mariota, but the difference this year all comes down to price. After going in Round 3 last year, Pitts now goes in Round 7 – when the wide receiver pool begins to really dry up. He’s one of my favorite players to target.

Note that TJ Hockenson’s target share spiked from 16.8% with the Lions to 20.7% with the Vikings post-trade. This easily marked a career-high for Hockenson after never coming close to broaching a 20% target share in his Lions career. Perhaps most importantly, Hockenson’s addition absolutely helped open up the Vikings passing game last season.

Justin Jefferson’s target share stayed the exact same (27%), and it came attached to more downfield targets. Jefferson’s average depth of target rose from 7.9 yards in Weeks 1-8 to 11.9 aDOT after the Hockenson trade because the Vikings finally had a tight end that could beat zone coverage underneath. That opened things up a bit for Jefferson over the top.

George Kittle’s target share in games that Deebo Samuel played last season was just 15.7%, which would have ranked a lowly 13th among tight ends. However, that jumped to 22% in the five games that Deebo missed or was severely limited in. With Deebo remaining WR1, CMC always dominating targets, and Aiyuk ascending – I have been avoiding Kittle at his ADP (55-65 overall). There is just too much fragility in his role when TEs like Pitts, Dallas Goedert, and Darren Waller are available 1-2 rounds later.

Cole Kmet (17.5% target share) vs. Evan Engram (16.3%) is a good example of why this analysis needs to come with some sort of team-level volume component. Not only were the Jaguars more pass-heavy than the Bears tendency-wise, Jacksonville’s receivers also saw more catchable targets from Trevor Lawrence relative to Justin Fields. Jaguars receivers saw 27.4 catchable targets per game (seventh-most) compared to the Bears in dead last (15.5).

I wrote way more about team-level catchable targets here.

Gerald Everett ranked just 23rd by target share (12%), but was a solid 12th by catchable targets per game (4.4) thanks to the Chargers' extreme pass-heavy offense and Justin Herbert’s great ball placement. There is definitely some hidden upside here for Everett if he runs more routes with this new staff led by OC Kellen Moore in L.A. Everett ran a route on just 57.7% of the Chargers' pass plays last season, which ranked 22nd among TEs. Everett has top-12 upside if he jumps into the 70-75% route share range like former-Cowboys TE Dalton Schultz.

Route share takeaways

After target share, route share (routes run divided by team dropbacks) is the second-most “sticky” volume stat year over year.

Remember, “stickiness” just tests how correlated a player's stats are year-over-year. In this instance, we are measuring 2021 route share against 2022 route share and find that the two are moderately correlated (0.583). That’s not as sticky as target share (0.695), but still very useful.

Let’s hit some analysis. Here are the top-24 tight ends by route share last season:

There are only a handful of every-down tight ends, but Mark Andrews is the one. Andrews easily led all tight ends in route share last season and ranked third (82%) in 2021, just behind Darren Waller (83.3%) and Travis Kelce (82.1%).

Wait… Waller?!

Last season was one to forget for Waller, as a hamstring issue limited him to just nine games. And after missing all of the middle of the season, Waller managed only part-time snaps when he was healthy enough to return in December. Ultimately, Waller only ran a route on 65.7% of the Raiders' pass plays last season. The Giants are planning that Waller can return to the full-time player he was in 2019-21.

Ideally, we would like to see Kyle Pitts back up to the 78.6% route share he had in his rookie season in 2021. It’s possible that Pitts was managing a hamstring injury (that caused him to miss Week 5) and take a few extra snaps off.

Greg Dulcich had a super impressive rookie campaign in 10 games, ranking 10th among tight ends in yards per game (41.1) thanks largely to strong early opportunity. Dulcich not only ranked 15th in target share (15%), he also ran a route on 75.9% of the Broncos' pass plays. That was the fifth-highest route share among tight ends, trailing only Andrews (83.4%), Kittle (78.1%), Kelce (77.6%), and Goedert (76.3%). Dulcich is a very intriguing Year 2 breakout candidate.

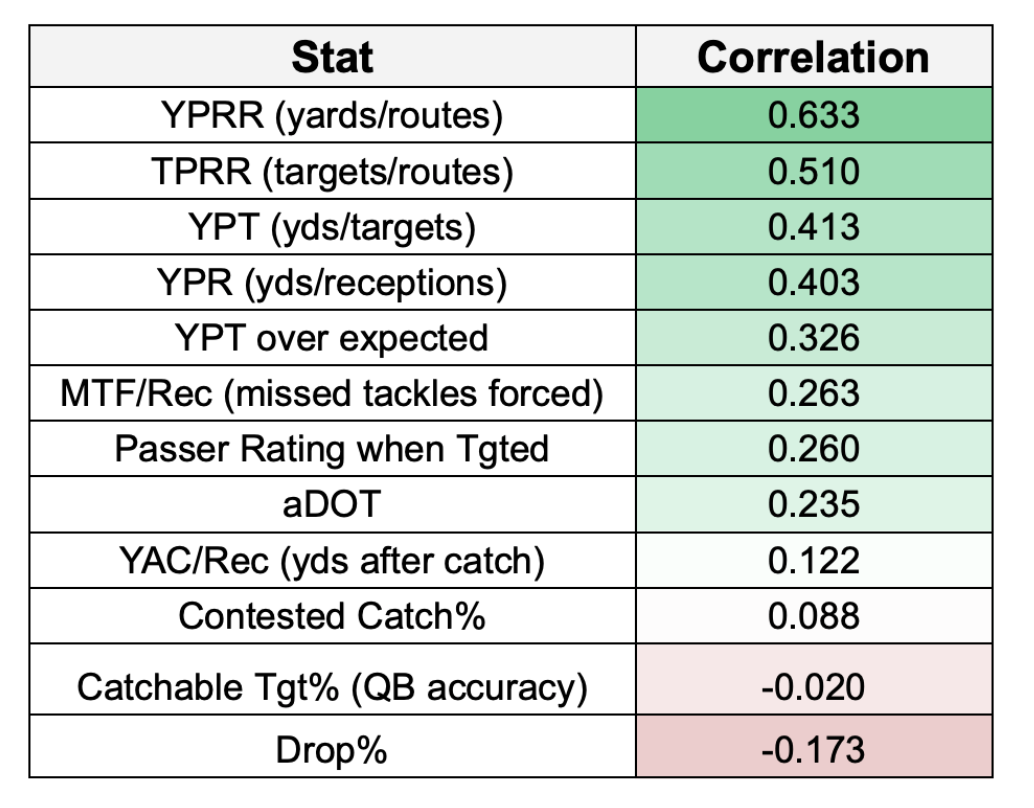

Efficiency Receiving Stats

Unlike with quarterbacks and running backs, we see two clearly solid efficiency stats for tight ends – yards and targets per route run.

YPRR is the GOAT stat for both TEs and WRs alike.

YPRR is the rare efficiency stat that is “sticky” year over year (0.662 correlation for tight ends). This basically just means that, without factoring in age- or skill regression, we can expect a tight ends YPRR to be relatively close to their previous years' figure. Most efficiency stats are pretty random; YPRR is not.

Since YPRR is the GOAT efficiency stat, it makes sense that the GOAT tight end Travis Kelce has dominated YPRR in his career – ranking top-3 among TEs in YPPR in 6-of-9 career seasons and never finishing worse than 7th in a single-season.

Kelce had a career-best season in receptions (110) and TDs (12) and the biggest question in fantasy this year is whether or not he can do something similar again.

To be clear, there are absolutely zero signs of fall-off looking deeper. Kelce averaged 6.12 yards after the catch and forced 0.25 missed tackles per reception, which is more or less right in line with his 2021 figures (6.43 YAC | 0.27 missed tackles forced per reception).

And, Kelce would have finished #1 in YPRR if it weren't for a certain rookie.

Here are last season's top-24 leaders in YPRR:

Yards per route run (YPRR)

Dallas Goedert has only scored 7 TDs on 145 targets across the last two seasons – tight ends live and die by touchdowns – so it’s seriously impressive that he’s finished as the TE10 and TE5 in fantasy points per game. As one of the best tight ends in the game after the catch, Goedert makes up for the lack of touchdown upside by being extremely efficient when he does get the ball. After finishing as the TE1 in YPRR (2.62) in 2021, Goedert followed that up with the TE3 finish (2.10) last season.

Chig Okonkwo (7.97) just barely nudged out Goedert (7.85) for the position lead in yards after the catch, as both were absolute beasts off of screens. A whopping 22.1% of Goedert’s targets were on designed plays (most), while Okonkwo (15.6%) wasn’t too far behind.

Ultimately, DeAndre Hopkins’ addition hurts Oknonwo’s target ceiling, but it will help him stay efficient and lead to more red-zone opportunities. I wrote more about the Hopkins signing – and why Derrick Henry is the big winner.

Again… Kyle Pitts was top-10 in every stat that matters last season. Except for fantasy points. **shudders**

Note that the Seahawks had not one… not two… but 3 tight ends in the top-24 tight ends in YPRR. Geno Smith can absolutely deal.

If we scale back the minimum route threshold – Jake Ferguson averaged 2.05 YPRR on 95 routes last season. He also forced 0.32 missed tackles per reception, which trailed only Oknonkwo (0.34) and Jonnu Smith (0.33). Between the small sample efficiency and open opportunity, there is more than enough to get excited about Ferguson as a last-round TE dart if you want a stash TE2 to finish off your drafts.

Dalton Schultz is leaving behind a very solid role, and Ferguson has the clear lead for the starting job, with rookie TE Luke Schoonmaker still nursing a foot injury that has him on the NFI list (as of 8/4). Over the last three seasons, Schultz averaged 5.9 targets per game and 66 receptions per season. Last year, his 17.7% target share ranked eighth-highest – just marginally behind Kittle.

A note on the rookie TE class

We’re seeing a drastic difference in the amount of time it takes for all rookie players to acclimate to the NFL and it shows up in small samples last season:

A rookie TE (Okonkwo) led all TEs in YPRR

Greg Dulcich was TE5 in route share (75.9%)

Jake Ferguson had very strong small sample efficiency numbers

Jelani Woods was TE14 in YPRR (1.58), Isaiah Likely was TE17 (1.51)

Cade Otton and Trey McBride didn’t have the efficiency numbers like their counterparts, but both were full-time players for their teams by the end of last season.

This is all to say…

The 2023 rookie tight end class is set up to produce in a way we haven’t really seen in the modern NFL. It’s a great, talented class that all have chances to not just play a lot – but start in Week 1.

Packers rookie TE Luke Musgrave has been running with the first team all off-season and remains a favorite best ball target.

Lions Sam LaPorta has been getting praised all off-season, most notably by OC Ben Johnson.

Dalton Kincaid is a seamless fit in the Bills' offense and plays a fundamentally different role than Dalton Knox. The Bills only ran 12 personnel at 5% and 6% rates on passing downs the last two years – so the hope is that the additional scheme flexibility from 2- and 3-WR sets help them become a more well-rounded offense.

Kincaid's ability will help unlock the offense this season (because of his versatility), but I don't see him producing consistently enough to warrant his high ADP relative to the rest of the TE market.

Michael Mayer is the least sexy of the bunch from an athletic standpoint, but he could absolutely outproduce them all as a rookie. Mayer is fighting veteran Austin Hooper for the 101 targets that Waller and Foster Moreau combined to see last season. Note that Hooper was a part-time player for the Titans' offense by the end of 2022… because of a rookie TE (Okonkwo).

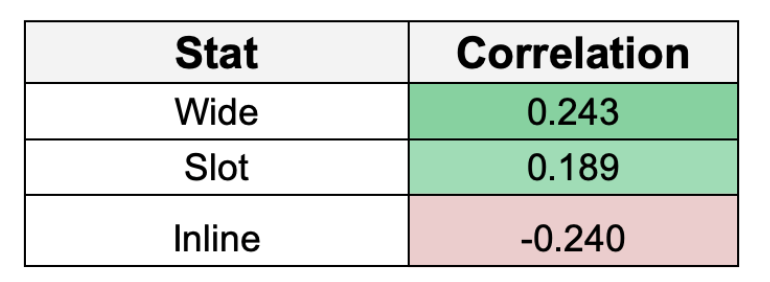

Alignment Stats

Before I finish up this article series, I thought this last bit of data was interesting. Here we look at how tight-end alignment on passing plays correlates with fantasy points. It’s a weak relationship, but notice that more routes inline are actually negatively correlated to scoring points.

This makes sense. Tight ends that run receiver-like routes either out wide or in the slot are getting targets further down the field.

On targets lined up inline (directly ‘inline’ with the line of scrimmage), the league-wide tight ends' average depth of target is 5.39 yards downfield. On targets lined up out wide or in the slot, we see tight end aDOT jump to 8.86 on average league-wide.

At the end of the day, this is a small part of the equation. Alignment stats are noisy at times, but this does paint a better picture of how we technically want our tight ends to run receiver-like routes as opposed to traditional inline usage.

Travis Kelce (34.1% out wide | 47.6% slot), Kyle Pitts (28.4% out wide | 44.7% slot), Evan Engram (23.8% out wide | 41.8% slot), and Mark Andrews (22.3% out wide | 66% slot) are all great examples of “tight ends” that all technically align as receivers.

All of the Fantasy Points Data in this article can be viewed at any time and at your own pace in the Advanced Receiving tool.